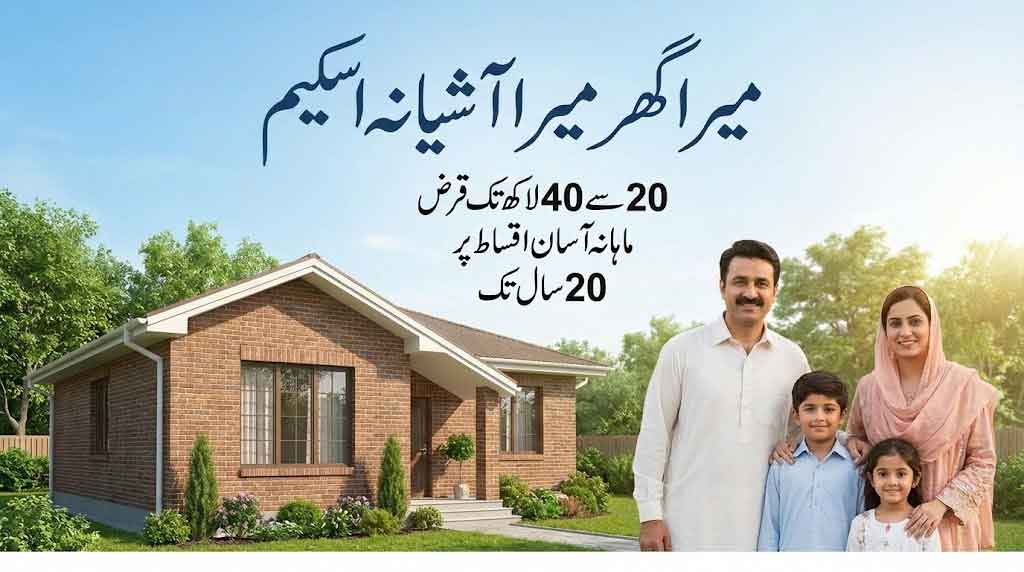

The Mera Ghar Mera Ashiana Scheme 2026 Apply Online, also known as the Prime Minister PM House Loan 2026, is a flagship housing finance initiative launched under the guidance of the State Bank of Pakistan (SBP). The scheme aims to help first-time homebuyers across Punjab, Sindh, KPK, Balochistan, AJK, and Gilgit-Baltistan fulfill their dream of owning a home through subsidized markup rates and long-term easy installments.

Visit your nearest branch or the official websites of SBP, HBL, Meezan Bank, Bank Alfalah, Allied Bank, JS Bank, Bank of Punjab, Bank of Khyber, HabibMetro, Soneri Bank, and Khushhali Microfinance Bank to apply online for the Mera Ghar Mera Ashiana Scheme 2026 and begin your homeownership journey.

Mera Ghar Mera Ashiana Scheme 2026 Apply Online For PM House Loan Start

The Mera Ghar Mera Ashiana Loan Scheme 2026 is one of Pakistan’s most comprehensive and inclusive housing finance programs. Backed by the State Bank of Pakistan and implemented through all major banks, it offers a golden opportunity for salaried and self-employed individuals to own a home with dignity, security, and affordability.

Mera Ghar Mera Ashiana House Loan 2026

All major public sector, private, Islamic, and microfinance banks in Pakistan are participating in this Markup Subsidy and Risk Sharing Scheme, ensuring nationwide accessibility.

What Is Mera Ghar Mera Ashiana Scheme 2026?

Mera Ghar Mera Ashiana 2026 is a government-backed housing finance program that provides affordable home loans for:

- Purchasing a ready-built house or flat

- Constructing a house on an already owned plot

The scheme is specially designed for low- and middle-income families who do not already own a house.

Provinces Covered Mera Ghar Mera Ashiana Loan 2026 Apply Online

The MGMA Loan Scheme 2026 is available across all regions of Pakistan, including:

- Punjab

- Sindh

- Khyber Pakhtunkhwa (KPK)

- Balochistan

- Azad Jammu & Kashmir (AJK)

- Gilgit-Baltistan (GB)

Scope of Financing Scheme Mera Ghar Mera Ashiana

Applicants can use the loan facility for:

- Purchase of constructed house

- Purchase of flat / apartment

- Construction of housing unit on owned plot

Mera Ghar Mera Ashiana Scheme Eligibility Criteria – Who Can Apply?

To apply for Mera Ghar Mera Ashiana 2026, applicants must meet the following conditions:

- Pakistani citizen holding a valid CNIC

- First-time house owner

- Must not own any residential property in their name

- One person can avail this subsidized loan only once

- Applicable for men and women

Minimum Income Requirement

- Minimum monthly income: Rs. 40,000

Age Limit

Salaried Individuals

- Minimum age: 21 years

- Maximum age: 60 years or retirement date (whichever is earlier)

Business / Self-Employed Individuals

- Minimum age: 21 years

- Maximum age: 65 years

Debt Burden Ratio

- Maximum allowed: 50%

Financing Limits (Tiers)

| Tier | Financing Amount |

|---|---|

| Tier-1 (T1) | Up to PKR 2.0 Million |

| Tier-2 (T2) | Above PKR 2.0 Million up to PKR 3.5 Million |

Maximum Loan Tenor

- Up to 20 years

- Markup subsidy available for first 10 years

Housing Unit Size Limit

- House: Up to 5 Marla

- Flat / Apartment: Up to 1360 sq. ft.

Markup Rates (Subsidized)

| Tier | Markup Rate |

|---|---|

| Tier-1 | 5% |

| Tier-2 | 8% |

PM House Loan to Value (LTV) Ratio

- 90:10 Ratio

- 90% financed by bank

- 10% equity by applicant

Bank Charges

- No processing fee

- No prepayment penalty

- Other charges as per bank’s Schedule of Charges (SOC)

Participating Banks Mera Ghar Mera Ashiana 2026

Public Sector & Specialized Banks

- State Bank of Pakistan SBP Mera Ghar Mera Ashiana Scheme

- National Bank of Pakistan NBP Mera Ghar Mera Ashiana Scheme

- The Bank of Punjab BOP Mera Ghar Mera Ashiana Scheme

- The Punjab Provincial Cooperative Bank PPCB Mera Ghar Mera Ashiana Scheme

- Zarai Taraqiati Bank ZTBL Mera Ghar Mera Ashiana Scheme

- First Women Bank Mera Ghar Mera Ashiana Scheme

Major Private & Commercial Banks

- Allied Bank ABL Mera Ghar Mera Ashiana Scheme

- Bank Alfalah Mera Ghar Mera Ashiana Scheme

- Habib Bank HBL Mera Ghar Mera Ashiana Scheme

- MCB Bank Mera Ghar Mera Ashiana Scheme

- United Bank UBL Mera Ghar Mera Ashiana Scheme

- Askari Bank Mera Ghar Mera Ashiana Scheme

- Bank Al-Habib Mera Ghar Mera Ashiana Scheme

- Soneri Bank Mera Ghar Mera Ashiana Scheme

- Faysal Bank Mera Ghar Mera Ashiana Scheme

- Habib Metropolitan Bank Mera Ghar Mera Ashiana Scheme

- Standard Chartered Bank Mera Ghar Mera Ashiana Scheme

- JS Bank Mera Ghar Mera Ashiana Scheme

- Samba Bank Mera Ghar Mera Ashiana Scheme

- Silk Bank Mera Ghar Mera Ashiana Scheme

- Summit Bank Mera Ghar Mera Ashiana Scheme

- Sindh Bank Mera Ghar Mera Ashiana Scheme

- Bank of Khyber Mera Ghar Mera Ashiana Scheme

Islamic Banks

- Meezan Bank Mera Ghar Mera Ashiana Scheme

- MCB Islamic Bank Mera Ghar Mera Ashiana Scheme

- BankIslami Pakistan Mera Ghar Mera Ashiana Scheme

- Dubai Islamic Bank Mera Ghar Mera Ashiana Scheme

- Al-Baraka Bank Mera Ghar Mera Ashiana Scheme

Microfinance Banks

- Apna Microfinance Bank Mera Ghar Mera Ashiana Scheme

- Khushhali Bank Mera Ghar Mera Ashiana Scheme

- NRSP Microfinance Bank Mera Ghar Mera Ashiana Scheme

- U Microfinance Bank Mera Ghar Mera Ashiana Scheme

- Mobilink Microfinance Bank Mera Ghar Mera Ashiana Scheme

How to Apply For Mera Ghar Mera Ashiana 2026?

- Visit the participating bank branch or official website

- Choose Mera Ghar Mera Ashiana / PM House Loan

- Submit CNIC, income proof, and property documents

- Bank conducts eligibility & credit assessment

- Loan approval under SBP Markup Subsidy Scheme

Key Benefits of MGMA Scheme 2026

- Government-subsidized markup rates

- Long-term repayment up to 20 years

- No processing or prepayment charges

- Available across Pakistan

- First-time homeowners focused

For accurate updates, always apply through official bank branches or SBP-approved portals only.