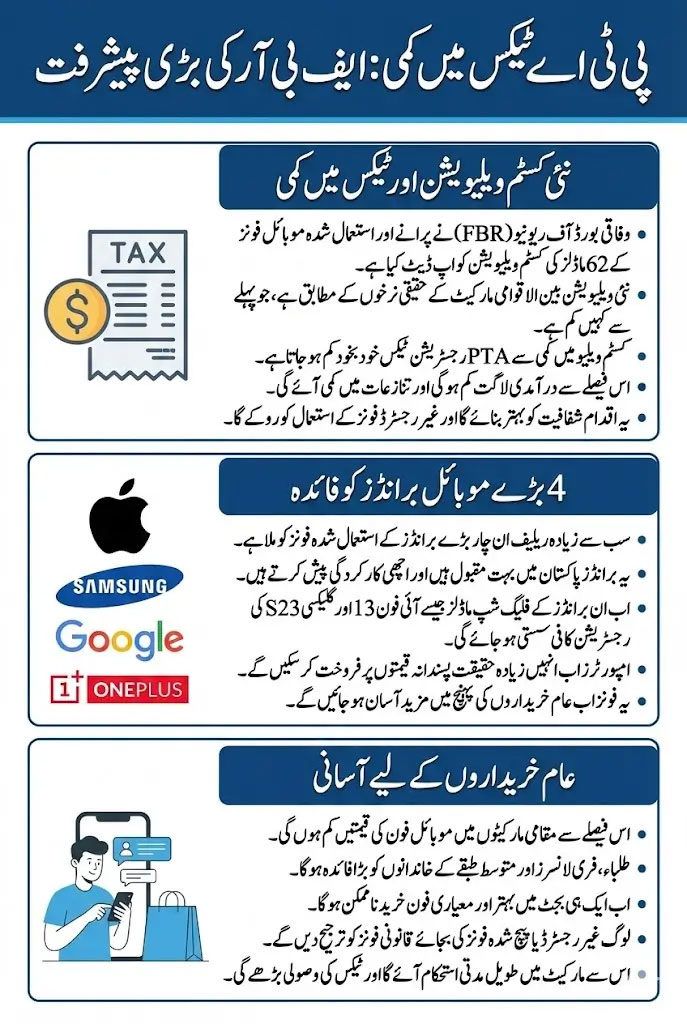

The Government of Pakistan has announced a major PTA tax reduction in 2026, bringing significant relief to mobile phone users across the country. Under the new policy, PTA mobile taxes have been reduced on selected imported mobile brands, including iPhone and Samsung, following coordination between PTA and FBR. This move aims to make smartphones more affordable and boost legal mobile imports.

PTA Tax Reduction 2026 Major Relief For Mobile Phone Users in Pakistan

The PTA tax reduction 2026 is a major relief initiative by the government, especially for users of iPhone and Samsung devices. Although PTA tax has not been fully removed, the reduction makes smartphone registration more affordable and encourages legal mobile usage in Pakistan.

PTA Tax Reduction News Today

According to the latest PTA tax reduction news today, the government has revised downward several components of the PTA mobile registration tax, including customs duty and withholding tax on specific smartphone categories. While the tax has not been completely removed, the reduction is being termed as one of the biggest relief measures for mobile users in recent years.

PTA Tax Reduced on iPhone (2026 Update)

One of the biggest highlights of PTA tax reduction 2026 is the reduced PTA tax on iPhone models. Previously, iPhone users had to pay very high registration charges, making devices extremely expensive.

iPhone PTA Tax – Before & After

- Old PTA tax on iPhone: Very high (especially on newer Pro & Pro Max models)

- New PTA tax on iPhone: Reduced significantly

- Result: iPhones are now more affordable for legal PTA approval

This update directly benefits users searching for PTA tax on iPhone, PTA tax reduced on iPhone, and PTA tax removed news today (partial relief, not full removal).

PTA Tax Reduction on Samsung Mobile Phones

Along with Apple, PTA tax reduction on Samsung smartphones has also been announced. Popular Samsung models in mid-range and flagship categories have seen lower PTA registration charges, encouraging users to register their devices instead of using illegal or patched phones.

This step supports:

- Legal mobile phone usage

- Increased PTA compliance

- Growth in smartphone accessibility

PTA Reduce Mobile Tax – What Has Changed?

Under the revised structure:

- Customs duty reduced on selected imported phones

- Regulatory duty adjusted

- PTA registration tax revised for certain price brackets

⚠️ Important:

The PTA tax is reduced, not fully removed. Claims of “PTA tax removed completely” are misleading, as users still need to pay registration charges, but at lower rates.

PTA Tax Calculator (Updated 2026)

Users can now check their updated mobile registration charges using the PTA tax calculator.

How to Use PTA Tax Calculator

- Enter mobile brand (Apple, Samsung, etc.)

- Select model

- Choose passport or CNIC option

- View updated PTA tax

The calculator reflects the latest PTA tax reduction 2026, helping users estimate the exact payable amount.

PTA Tax Removed News Today – Reality Check

Many users are searching for “PTA tax removed news today”, but it is important to clarify:

✅ PTA tax reduced

❌ PTA tax not completely removed

The government has provided partial tax relief, not a full exemption.

PTA Tax on iPhone – Summary

- PTA tax on iPhone reduced

- Lower registration charges for newer models

- Still mandatory to register imported phones

- Relief mainly benefits premium phone users

This update addresses all major concerns related to: